Want to manage vendor risks effectively? Third-party risk scoring helps you evaluate vendors based on compliance, security, financial health, and operational reliability. It ensures smarter decisions, improves compliance, and builds customer trust. Here's how it works:

- What is Risk Scoring? Assigns numerical values to vendor risks like data handling, security, and compliance.

- Why It Matters: Speeds up sales cycles, meets regulations, reduces costs, and enhances trust.

- Key Areas to Assess: Security, compliance, financial stability, and operational performance.

- How to Score: Use weighted metrics (e.g., compliance = 30%, security = 25%) and calculate scores to categorize vendors (e.g., Critical = 80–100, Low = 0–39).

Quick Tip: Regularly review vendor performance and adjust your scoring system to stay updated with regulations and threats.

Keep reading for step-by-step guidance on creating a scoring system, risk limits, and actionable plans.

6 Steps to Completing a Vendor Risk Assessment Process

Setting Risk Criteria

Main Risk Factors

When evaluating vendors, focus on these four key areas:

| Risk Domain | Key Assessment Areas |

|---|---|

| Financial Health | Credit ratings, revenue trends, market standing |

| Operations | Business continuity, service reliability, disaster recovery |

| Security | Data protection, access controls, incident management |

| Compliance | Regulatory certifications, audit records, policy adherence |

Creating Risk Metrics

To effectively measure risk, use metrics that are both quantifiable and meaningful. Combine numerical data with qualitative insights:

| Metric Type | Measurement Method | Weight |

|---|---|---|

| Compliance Status | SOC2, HIPAA, ISO27001, GDPR verification | 30% |

| Security Controls | Technical assessment scores | 25% |

| Financial Stability | Credit ratings and financial ratios | 25% |

| Operational Performance | SLA adherence and uptime metrics | 20% |

"Our Compliance Services ensure your company meets the necessary regulatory requirements without the headaches... By achieving and maintaining compliance, you not only avoid costly fines but also enhance your market credibility, speeding up your sales cycles and boosting customer trust." - Cycore Secure

Once metrics are in place, set clear boundaries to guide how risks are managed.

Risk Limits

After defining your metrics, establish thresholds to determine the necessary actions for vendors based on their risk levels.

- Regulatory Requirements: Align thresholds with specific regulations. For example, healthcare vendors need stricter limits to comply with HIPAA standards.

- Data Sensitivity: The more sensitive the data, the stricter the risk tolerance. Vendors managing protected health information (PHI) or personally identifiable information (PII) should face tighter limits.

- Business Impact: Assign stricter thresholds to vendors critical to your operations compared to less essential ones.

"Our Virtual CISO (Chief Information Security Officer) service provides you with experienced security leadership at a fraction of the cost of a full-time hire. We help you develop and implement a robust security strategy tailored to your business needs." - Cycore Secure

A tiered structure can help categorize risk levels and outline actions:

| Risk Level | Score Range | Required Actions |

|---|---|---|

| Critical | 80-100 | Immediate remediation or terminate the contract |

| High | 60-79 | Develop a corrective action plan within 30 days |

| Medium | 40-59 | Schedule quarterly reviews and monitoring |

| Low | 0-39 | Conduct annual assessments |

Building a Scoring System

Scoring Methods

Choose a scoring method that fits your organization's needs:

| Scoring Method | Best For | Key Characteristics |

|---|---|---|

| Quantitative | Large enterprises | Uses numerical data, statistical tools, and precise metrics |

| Qualitative | Small businesses | Relies on expert opinions, categorical ratings, and adaptability |

| Hybrid | Mid-market companies | Blends numerical data with expert judgment for a balanced approach |

The hybrid method often strikes the right balance, combining hard data with expert insights. It's especially popular with organizations that need to align with frameworks like SOC 2 and HIPAA while keeping scoring practical.

Once you've selected a method, assign specific weights to risk categories based on your business priorities.

Risk Factor Weights

Assign weights to different risk factors by considering their impact on your operations. Use these industry-standard ranges as a starting point:

| Risk Category | Weight Range | Critical Indicators |

|---|---|---|

| Security Controls | 25–35% | Includes access management, encryption, and incident response |

| Compliance Status | 25–30% | Covers regulatory certifications and audit performance |

| Financial Health | 20–25% | Focuses on credit ratings and market strength |

| Operational Risk | 15–20% | Looks at service reliability and business continuity |

Score Calculation

Follow these steps to calculate risk scores:

-

Data Collection

Use standardized templates to gather vendor responses for consistency. -

Normalization

Convert all measurements to a 0–100 scale for easier comparison:- Compliance: Full compliance = 100, Partial = 50, None = 0

- Security: Map technical assessments to percentage scores

- Financial: Translate ratings into percentage equivalents

-

Weighted Calculation

Calculate the final score using this formula:

Final Score = Σ (Individual Score × Weight) Example:

For scores of 85 (Security Controls, 30%), 100 (Compliance, 30%), 90 (Financial Health, 25%), and 95 (Operational Risk, 15%), the total score would be 92.3/100.

"With Cycore, there's no need for my team and I to worry about security and privacy. Cycore keeps us up to date on our compliance program and notifies us ahead of time if they need something from us."

– Nils Schneider, CEO & Co-Founder, Instantly

sbb-itb-ec1727d

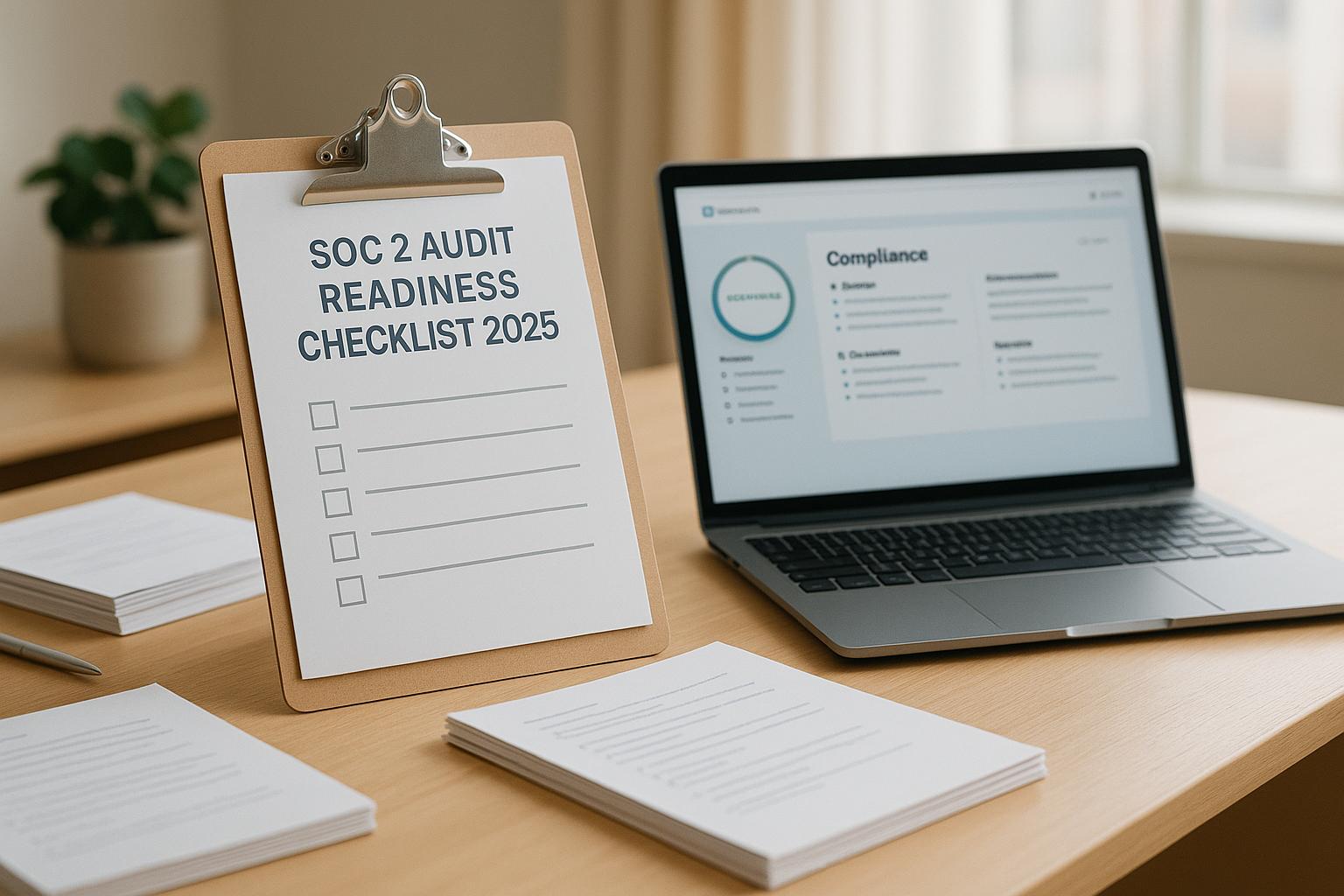

Vendor Risk Assessment Steps

Getting Vendor Data

Start by collecting detailed vendor information using standardized tools. Use questionnaires to address critical risk areas, such as:

| Assessment Area | Required Documentation | Verification Method |

|---|---|---|

| Security Controls | SOC 2 reports, penetration test results | Independent audit review |

| Compliance Status | Regulatory certificates, audit reports | Certificate validation |

| Financial Health | Credit reports, financial statements | Third-party verification |

| Operational Risk | Business continuity plans, SLA reports | Document analysis |

Ensure vendors submit their responses through secure, encrypted channels. Set clear deadlines and keep thorough records of all submissions.

Data Verification

Once vendor data is collected, confirm its accuracy through a multi-step verification process:

-

Primary Source Verification

Review original documents directly from the issuing authorities. For instance, validate SOC 2 reports via the AICPA database or ISO certifications through accredited bodies. -

Independent Assessment

Use trusted third-party services for external checks. This could include financial health reviews from credit agencies or security evaluations using vulnerability scanning tools. -

Regular Updates

Set up automated alerts to track changes like certificate expirations, compliance issues, or new risks. This ensures you stay up-to-date on vendor statuses.

Risk Score Analysis

After verification, turn the data into actionable risk scores to categorize vendors effectively. Use a structured framework to assign vendors to risk levels based on their scores:

| Risk Level | Score Range | Required Actions |

|---|---|---|

| Critical | 90–100 | Monthly review; immediate mitigation plans |

| High | 75–89 | Quarterly assessment; enhanced monitoring |

| Medium | 50–74 | Semi-annual review; standard controls |

| Low | 0–49 | Annual assessment; basic monitoring |

Focus on vendors with the highest impact, particularly those managing sensitive data or essential business operations. Use these scores to allocate resources and craft targeted strategies to reduce risks.

Keep your risk assessment process flexible to respond to changing business needs and emerging threats. Regular reviews ensure your scoring system stays useful and up-to-date.

Using Risk Scores

Risk Level Groups

Once you've calculated vendor risk scores, group vendors into specific risk categories to streamline management efforts. Design a framework that reflects your organization's risk tolerance:

| Risk Category | Score Range | Monitoring Requirements | Required Controls |

|---|---|---|---|

| Critical | 90-100 | Daily monitoring, weekly reports | Enhanced encryption, real-time alerts, quarterly audits |

| High | 75-89 | Weekly monitoring, monthly reports | Multi-factor authentication, monthly security scans |

| Medium | 50-74 | Monthly monitoring, quarterly reports | Standard security controls, semi-annual reviews |

| Low | 0-49 | Quarterly monitoring, annual reports | Basic security measures, annual assessments |

These categories help guide the tailored risk management strategies outlined below.

Risk Reduction Plans

Your approach to risk reduction should align with the vendor's assigned risk level:

- Critical Risk Vendors: Implement strict mitigation plans, including advanced security measures, clearly defined SLAs, and continuous monitoring systems.

- High Risk Vendors: Focus on consistent oversight, regular evaluations, and ensuring required security certifications are in place.

- Medium Risk Vendors: Use standard monitoring practices with periodic security checks and maintain basic control documentation.

- Low Risk Vendors: Apply basic security measures and conduct annual assessments to ensure compliance.

Regular Reviews

After putting risk reduction plans into action, it's essential to routinely assess vendor performance to maintain compliance and security standards:

| Review Type | Frequency | Key Activities |

|---|---|---|

| Comprehensive Assessment | Annual | Full risk reassessment, documentation review, control validation |

| Security Posture Check | Quarterly | Evaluate control effectiveness, test incident response |

| Compliance Verification | Monthly | Confirm certificate validity, address regulatory updates |

| Real-time Monitoring | Continuous | Track security alerts, performance metrics, and incidents |

Consider using tools like Cycore Secure to simplify compliance management and ensure consistent vendor monitoring.

Stay proactive by updating your risk criteria to reflect:

- Shifts in regulatory requirements

- Emerging security threats and vulnerabilities

- Changes in industry standards

- Evolving business environments

Risk Scoring Tools

Software Options

When evaluating vendor risk scoring tools, focus on features that align with your compliance requirements. Many modern GRC platforms provide a mix of essential and advanced capabilities:

| Feature Category | Basic Features | Advanced Features |

|---|---|---|

| Compliance Support | SOC2, HIPAA, ISO27001, GDPR frameworks | Integration with custom frameworks |

| Monitoring | Real-time threat detection | Automated alerts and notifications |

| Integration | API connectivity | Custom workflow automation |

| Reporting | Standard compliance reports | Customizable dashboards |

| Vendor Management | Basic assessment tools | Advanced risk analytics |

Key considerations for selecting tools:

- Ensure they integrate smoothly with your existing systems and allow for customized risk metrics.

- Opt for real-time tracking of vendor compliance and security status.

- Look for tools that receive regular updates to address new threats and regulatory changes.

Cycore Secure Services

If you need expert assistance, Cycore Secure provides specialized GRC Tool Administration services. Their tiered service model offers options tailored to different organizational sizes and needs:

| Service Tier | GRC Tool Support | Key Features |

|---|---|---|

| Start-up | Single tool admin | Basic vendor management, initial compliance assessment |

| Mid-Market | Two tool integration | Advanced GRC administration, monthly vulnerability reports |

| Enterprise | Up to 4 tool integration | Custom security roadmaps, continuous monitoring |

Cycore Secure stands out by offering:

- Tool Configuration: Professional setup and maintenance for GRC platforms.

- Framework Compliance: Expertise with multiple standards like SOC2, HIPAA, and ISO27001.

- Ongoing Management: Regular updates to keep tools running efficiently.

- Scalable Solutions: Options designed to grow alongside your business.

Summary

Steps Overview

Here’s a quick guide to setting up an effective third-party risk scoring system:

| Implementation Phase | Activities | Outcomes |

|---|---|---|

| Initial Setup | Define risk criteria, create metrics, set limits | A clear framework for assessing risk |

| Scoring System | Develop methods, assign weights, establish calculations | A consistent process for evaluation |

| Assessment Process | Collect vendor data, verify details, analyze scores | Accurate profiles for vendor risks |

| Management | Categorize risk levels, create reduction plans, schedule regular reviews | Practical steps for managing risks |

These phases provide a structured approach to building a reliable system.

Business Benefits

A third-party risk scoring system offers three major advantages:

-

Improved Efficiency

- Simplifies vendor assessments and compliance management.

- Reduces operational workload with a systematic approach.

-

Financial Gains

- Helps avoid costly compliance penalties.

- Lowers staffing expenses.

- Makes better use of available resources.

-

Stronger Market Position

- Speeds up sales cycles by improving due diligence.

- Strengthens customer trust.

- Sets your business apart with robust security practices.

"Cycore Secure empowers you to quicken your sales cycles by efficiently managing compliance challenges... By outsourcing your security and compliance needs to us, you avoid the lengthy processes that typically slow down sales negotiations, enabling your company to focus on rapid growth and market expansion."

Lastly, maintaining the system requires regular audits, monitoring vendors continuously, detecting threats in real-time, and updating scoring criteria periodically.